Get Your Money Right

Budgeting

Budgeting is not about restriction. It’s the gift of knowledge - knowing what you have and what you can spend while still achieving your goals. It’s an empowering way to take control of your finances and your future.

It also doesn’t have to be intimidating or overly complicated. The key is to find the method that works best for you so that you’ll actually stick with it.

Here are some simple steps to get started in getting your money right.

Step 1 - Know What You’re Working With

First, you need to get the lay of the land.

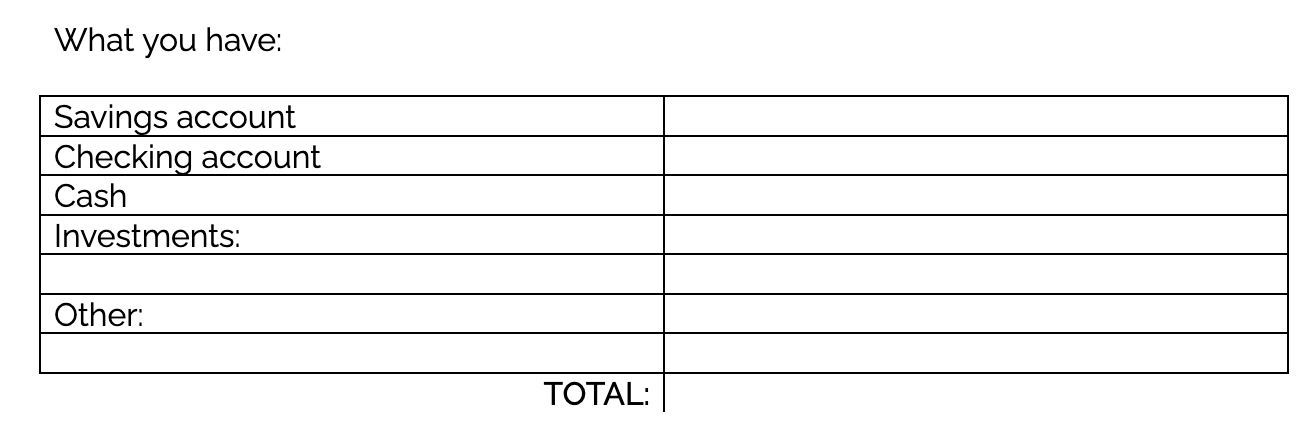

What do you have?

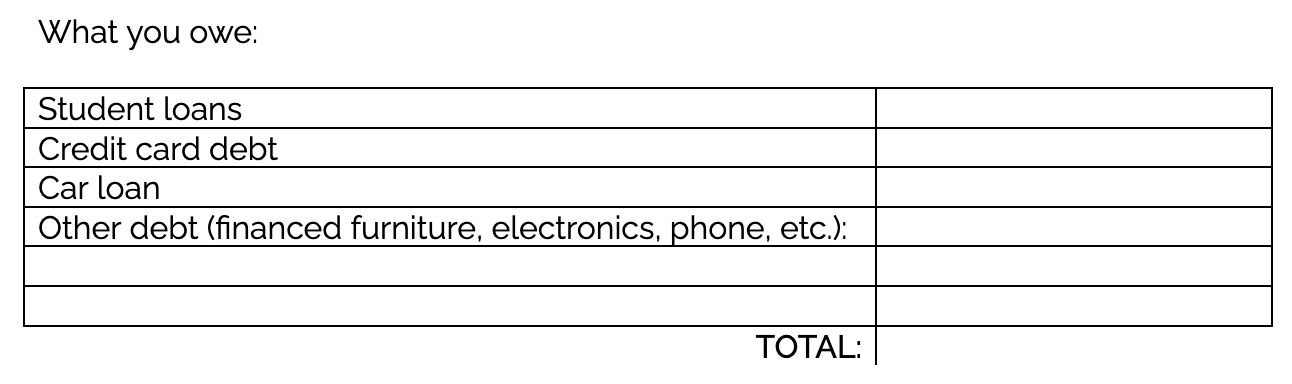

What do you owe?

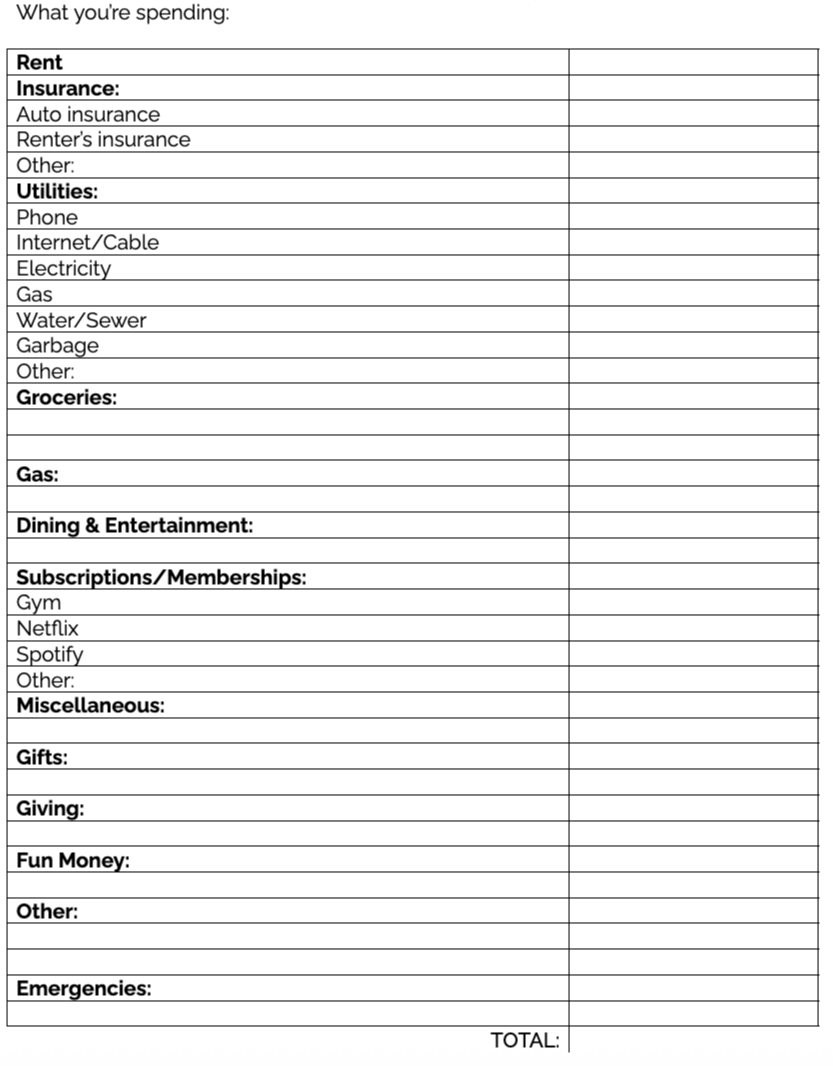

What are you spending?

Unless you have really let things go off the rails, the first two steps should be fairly simple. Take a few minutes to log into your accounts and write down everything you have. Include money in savings accounts, checking accounts, cash, and any investments (don’t forget about workplace retirement accounts). If you own anything of value (such as a house or vehicle), you may want to include those items here, as well.

These are your assets.

If you’re not clear on how much money you are bringing in each month, this would be a good time to get clarity on that number, as well.

You can jot this down on a piece of paper, a Google doc, or (per my recommendation, as always) you can create a simple spreadsheet to keep track of everything.

The next step works the same way, but you’re logging into your debt accounts. This may include a credit card balance, student loans, or car payments.

If you have been sucked into any Buy Now, Pay Later offers or have financed consumer goods like an appliance, you’ll want to include that here, as well.

These are your liabilities.

Next, you need to figure out what you’re currently spending. If you have never had a budget, you probably have no idea how much money you actually spend in certain categories. Rather than declaring, “I think I should set my take-out budget to $100 a month,” just to find out that you actually spend closer to $300, start with some data.

If most of your spending is on a credit or debit card, you already have the data and can curate it from your past spending. Pull up your previous statements, and add up your transactions into categories.

If not, you’ll need to spend your first month writing down everything you spend so can do this exercise.

The categories below are samples. Determine what categories are most appropriate for your life and situation. Be as broad or as specific as you feel is valuable for your situation.

Step 2 - Create Your Budget

Now that you know what you have, what you owe, and what you’ve been spending, do some basic analysis. Are you spending more than you’re making? Do you have significantly more debt than savings? Do you have so much in savings that you could easily pay off some high-interest debt? Are you spending the vast majority of your income in one category? Are you spending much more or less than expected in any given category?

Now is the time to set your budget, based on your data.

Maybe you’re spending $1,000 on groceries, and you feel like you can cut that down. Don’t set your budget at $300 right off the bat. Make a realistic goal or set a progressive goal to decrease it over time - with a plan. If you want to decrease your grocery budget, make a plan to meal prep, find recipes that use lower-cost ingredients, or shop at a cheaper grocery store. Spending less money doesn’t happen by accident.

If you are spending a lot on concert tickets, but that is important to you, consider where you can make cuts in other areas that don’t bring you as much value. Is your weekly takeout really worth it if the trade-off is missing out on a concert? Maybe. That’s up to you to determine.

I recommend starting your budget in a spreadsheet (of course!) or something simple and manual. Once you are comfortable with the categories and numbers, finding a tool that will help automate and streamline the process will help you stick with it.

Step 3 - Find the Right Tool

I manually entered every transaction into a spreadsheet for many years. In some ways, I found this to be helpful, as I had to collect every receipt and be very conscious of every transaction. I realize that this level of attention to detail won’t work for everyone, and the last thing I want is for the process to be too burdensome to follow through with.

There are many great budgeting apps, and while they charge a small fee, I find it to be worth it for the financial control a budgeting tool can contribute to.

My favorite is Copilot. Use my referral code REG8QY to get 2 months free here.

This app has so many great features, and I love it in a weird, nerdy way! It allows you to link and live track your spending as well as your assets and liabilities. It tracks your net worth and has very customizable categories and subcategories. One feature I love is that with the credit card sync function, it shows pending transactions, so you don’t have to wait until transactions settle for them to reflect in your budget.

I used EveryDollar for many years. There is a premium subscription that includes automatic syncing with your accounts, but there is a free version for manual tracking.

Another option that I have never used but have heard good things about is YNAB (You Need a Budget).

Step 4 - Build Your Financial Foundation

Once you get comfortable with setting and following a budget, you can move past survival mode and start building a healthy financial foundation that will open the door to endless possibilities.

Emergency fund

One of the most important things you can do today to protect your progress and prevent backsliding into financial ruin is to save up an emergency fund. Without it, a simple car repair or medical emergency could derail all of your hard work.

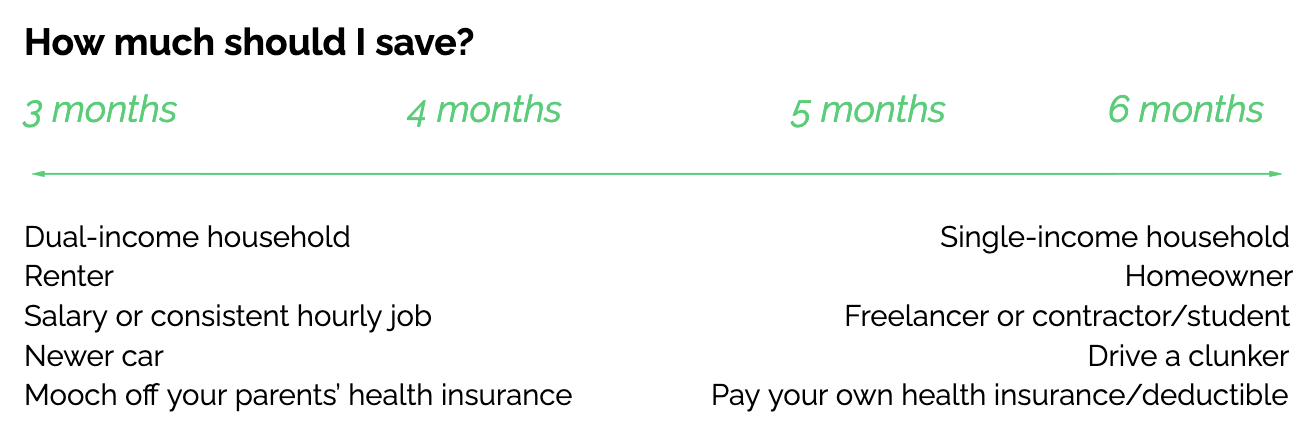

You will want 3-6 months of expenses saved in a liquid account (preferably a high-yield savings account). Use the graph below to determine if you should lean towards 3 or 6 months.

Retirement

This may be hard to wrap your mind around when you are barely scraping by, but don’t wait to start investing for your retirement! Even if you start small.

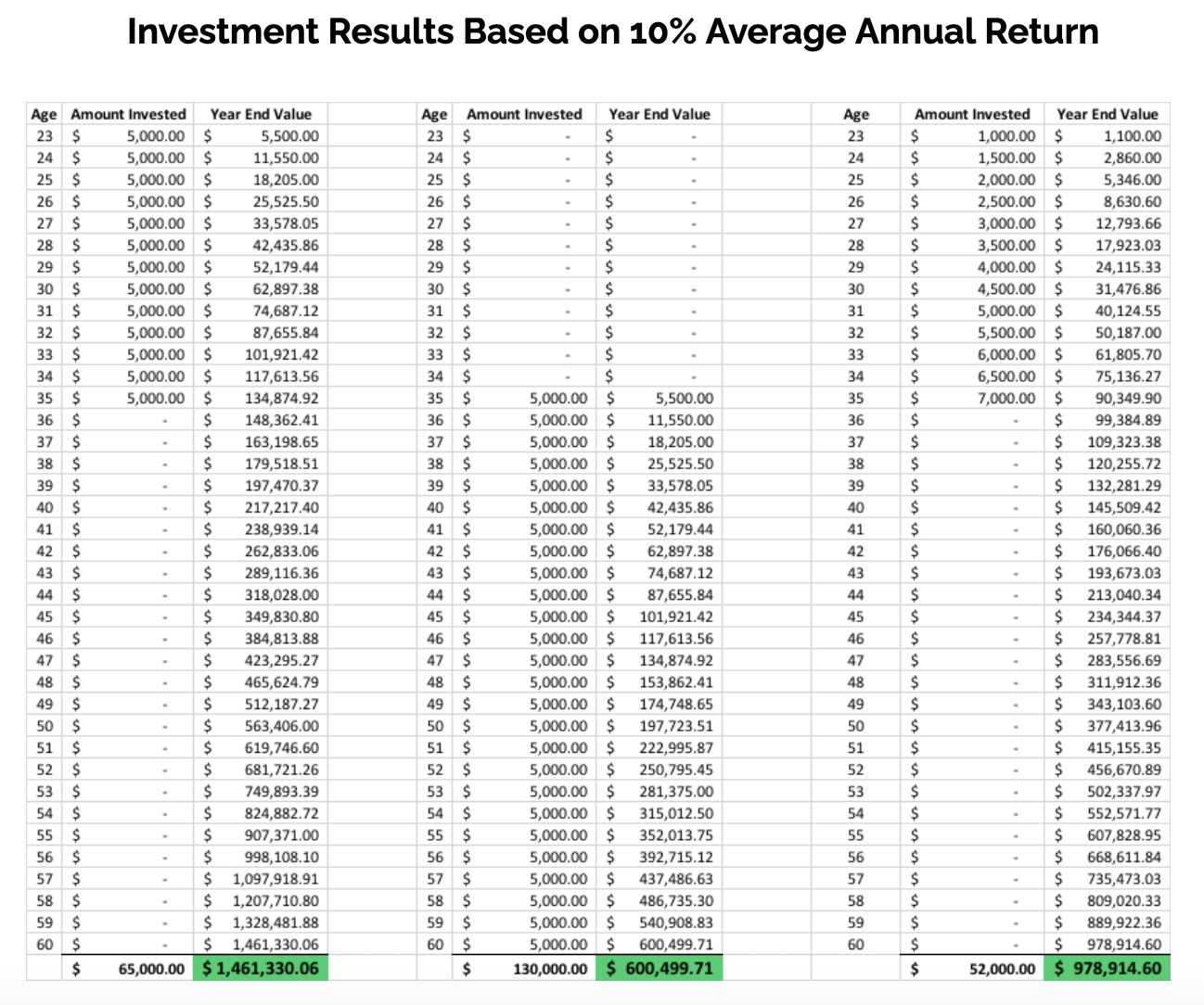

The chart below shows how compound interest can work in your favor if you start investing now. If you are in your early twenties and invest $5,000 a year until you’re 35 then never invest another penny, you’ll be a millionaire by the time you retire! If you wait to start investing until you’re 35, you’ll spend twice as much and earn less than half. If $5,000 a year (about $416 per month) seems like a lot for you to start investing now, start with $1,000 next year (about $83 per month) and increase it by $500 per year. Even if you stop at age 35, you’ll still be nearly a millionaire by the time you retire.

If you’re buried in debt or struggling to find a sustainable source of income right now, just start by investing some birthday or Christmas money each year to get the compound interest machine started. Or if your employer offers an employee match program, at least commit to the maximum percentage that they will match. You don’t want to leave that free money on the table.

Investments

Investing is less scary than you may think! Once you get to the point of having a little extra dough, make those dollars go to work for you!

There are online options that allow you to start investing with as little as just a few bucks, and they are completely hands-off. These “robo-advisors” do all the work for you for little to no cost, and as long as your account is not a retirement fund, you can take the money out whenever you need it.

Wealthfront and Betterment are leaders in the space. I’ve also used Acorns, which allows you to link your credit card, and it will automatically round up all of your purchases and invest the spare change.

Check out this article on NerdWallet (this website is a great financial resource for you, in general) that does a more in-depth comparison of some of the most popular robo-advisors.

One thing I do not recommend, especially for an amateur investor, is day-trading or investing in single stocks. It’s far too risky and requires a lot more know-how.

Saving for a large purchase

Right now, you may not be thinking about buying a house or a new car, but eventually, you will, and it never hurts to start putting $50-100 per month towards these things so that when you really start getting serious, you’re not starting from scratch.

Here are some things you may want to start saving for:

Car

Vacations

Graduate school

Wedding

Down payment on a house

You can use a traditional savings account for these things, or if you know they’re still a long way off (5+ years), consider using one of the investment options above, so you can earn up to 10% interest on your savings. If you are going to put this money in a savings account, make sure it’s a high-yield account. I’ve banked with Ally for many years, and you can view the current interest rate for a savings account here. That’s a lot better than stashing cash in the closet and losing money over time due to inflation!

Step 5 - Set Goals

Now that you have the knowledge, tools, and foundation, you can confidently set goals and make a plan for achieving them. Your goals may relate to any of the previous steps, or you may be ready to take on some more advanced goals.

Here are some potential goals to consider.

Know where my money is going

Increase my income

Pay off my student loans

Pay off all of my debt

Spend less money than I make

Save up an emergency fund

Invest in a retirement fund

Save up for a new car

Save up for a down payment for a house

Save up for a vacation

Invest in the stock market

Put $_______ in savings each month

Determine what your short-term (1-3 year) goals are and what your long-term (3+ years) goals are. Then determine the priority. You may want to save up for a house, but do you want to take on a mortgage while you have a large amount of student debt?

Setting goals and priorities will help you decide how strict or lenient you want to be on your budget. If you really want to buy a house in the next few years but have $0 saved up for a down payment, you may realize that making some significant cuts in your spending is necessary and worth it to achieve your goal of buying a home.

Step 6 - Make it a Habit

In order to make these changes stick and see real progress, you’ll need to introduce some new habits. Check your spending regularly to see where you stand in each spending category. Using an app makes this really easy. You can set up notifications to categorize transactions as they come in, or make yourself a recurring reminder to check in once a week, etc.

The most important habit to incorporate is a Monthly Money Date with yourself. I have come to really enjoy this time because I love seeing our progress. I recommend blocking off time on the first or last day of the month to review your assets and liabilities and check in on the progress of your net worth as well as review where you landed with your budget for that month. What categories were you over or under? Where can you clean things up for next month? Should you adjust some of your budget categories based on recent trends? Pour yourself a glass of wine and make an event of it!

Things to Think About

What is your why?

If you don’t have clarity on your “why” or the reason that you want to get your money right, it will be hard to stick to it. Discipline for the sake of discipline gets old fast. But if you determine, for example, that you want financial freedom in 10 years so you can work less and coach your child’s elementary school basketball team, it will be easier to convince yourself to forego that takeout for a home-cooked meal.

There are endless reasons that could drive you to want to get your money in order. Maybe you simply want to worry less and not be in the dark about your finances. Maybe you want to pay off your student debt. Maybe you want to be able to buy a home. Maybe you want to retire early. Maybe you want to be able to take a pay cut to change careers.

Regardless of what the “why” actually is, it’s important to know it and make it your north star.

Conscious spending plan

Ramit Sethi of I Will Teach You to Be Rich uses the term “Conscious Spending Plan” rather than “budget.” As you move out of survival mode, this is a much better way to think about your spending. The term 'budget' may feel limiting, but you will eventually come to realize that having a plan for your money is freeing. Ramit recommends dedicating 20–35% of your take-home pay to your “guilt-free spending” category. This requires you to determine the things in life that bring you the most joy, then build in freedom to fully enjoy them.

If expensive clothes don’t thrill you, then why stretch yourself thin to keep up with the Lululemon Joneses when off-brand leggings get the job done? You may realize that you’re blowing money on things you don’t really value, which is preventing you from spending money on things that truly bring you joy in life, like traveling or going to concerts.

If you are stepping into this process from a place of desperation and are hemorrhaging cash every month and buried in debt, the conscious spending plan may be a little advanced for you. You may have to start with a budget to limit your spending and get things on track. Once you are comfortable with the process and can transition to goal-setting, you can really think about what things fit into your “guilt-free spending” category and give yourself the freedom and encouragement to enjoy spending that portion of your income.